Why Do We Save So Little?

And how can we save enough to retire in spite of inflation, increased life spans, and the rising costs of health care?

And how can we save enough to retire in spite of inflation, increased life spans, and the rising costs of health care? Many Americans approaching retirement have not saved nearly enough. One-third of workers age 55 or older have a nest egg of less than $25,000, according to a 2016 survey by the Employee Benefit Research Institute. A recent Boston College study found that when kids leave home, empty-nesters typically increase their 401(k) saving by less than 1% of pay. If unemployment, market volatility, health issues, or college costs have taken a bite out of that nest egg, it may not be large enough to allow them to retire on schedule.1

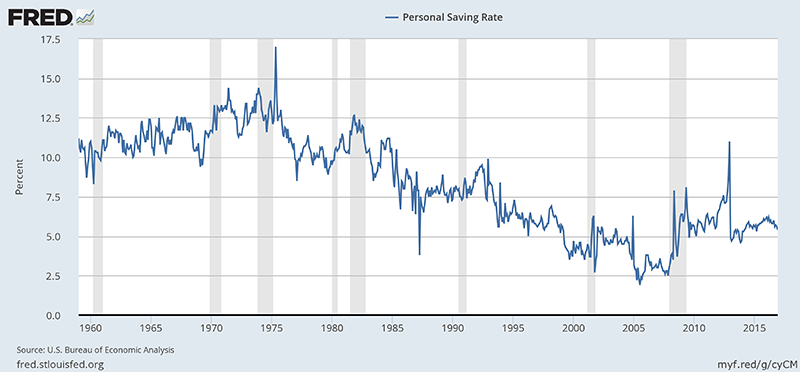

The "greatest generation" had a culture of saving. Its thrift was reinforced further by hard times and a call for personal sacrifices as the economy endured the Great Depression and stateside rationing during WWII. The Commerce Department began measuring household saving in 1959, and as unbelievable as it may seem today, households saved 10% or more of their disposable incomes through nearly all of the Sixties. In May 1975, the personal savings rate reached a historic peak of 14.60%.2

Personal Saving Rate (PSAVERT), which the Commerce Department calculates as the ratio of personal saving to disposable personal income.

From 1959 to the present, the PSAVERT average has been 6.84 percent - but during the 21st century, the savings rate fell into the 1-3% range, dropping to a record low of 0.8% in April 2005. In January 2013, households were saving just 2.3% of their disposable incomes - so this can be labeled a short-term improvement. It still pales in comparison to the way Americans used to save. Source: research.stlouisfed.org/fred2/series/PSAVERT/

To some analysts, a declining personal savings rate signals a stronger economy. It implies more spending, and consumer spending has the biggest impact on GDP. You can’t have it all, however; more spending means less saving, and Americans are plagued by insufficient retirement reserves.

For many Americans, retirement may not even be on the radar. A 2016 study by consultants Hearts & Wallets reveals that only one-third of couples surveyed have even discussed retirement planning. 1

Are credit cards the problem? Payments on high interest debt can certainly reduce the ability to save. According to research from WalletHub, Americans charged $34.4 billion to their credit cards in the second quarter of 2016 - the biggest second-quarter jump seen in 30 years. In 2015, U.S. consumers piled on $71 billion in credit card debt, the greatest annual increase since 2007. 3

Census Bureau data shows the median U.S. household income for 2012 at $51,017. By comparison, median U.S. household income in 1989 - when adjusted for inflation - would work out to $51,681 today. From 1989-2012, annualized consumer inflation was mostly in the 2-4% range. All this illustrates a slow but notable erosion of purchasing power.4,5

Real incomes aside, when there is a will to save, there is usually a way. Establish a regular system of saving, and have an idea of how much you need to accumulate to cover your monthly retirement expenses. For a rough guess, consider your current monthly expenses, and how they may change in retirement. Then use the calculator below to consider different retirement savings amounts and how long they may last given the monthly retirement spending you estimated. Keep in mind that if you retire at 65 and are fortunate enough to live past 90, your retirement savings will need to last more than 25 years, and how health care costs and general inflation may affect budget over the course of a quarter-century.

Make a habit of considering your financial future. Are those dollars you are spending at a mall or restaurant today better off saved or invested for tomorrow? If you purchase an item on credit, consider the true price you will pay including the interest.

Set your savings budget and track your progress. Your savings budget has to fit within your current income and expenses, so it helps to consider your savings goals each time you review your finances. Regularly track how many dollars you have invested in your retirement account - celebrate each cycle you achieved your savings goals and make adjustments when you find yourself falling behind. If you have trouble setting aside enough each month, try saving smaller amounts as part of a weekly payment plan, or target monthly budget items you can reduce or eliminate in order to meet your savings goals. In spite of flat wages, Americans can improve their savings habits. In May 2016, U.S. households on average were saving 5.3% of their disposal personal income, up from 4.8% a year earlier. 6

Simplify and Automate. Establish automated transfers into your retirement accounts and dramatically increase your savings success. Consider simple rules to increase saving like setting aside 25% to 50% of unplanned windfalls such as bonuses, profits from sale of an asset, gifts, or inheritance. If you get a raise, save the entire increase in pay from the first month and half for the next 12 months or indefinitely if you can. Setting guidelines up front and applying them to all situations will keep you in the habit of saving, in the same way that living within a budget makes it easier to control spending.

1 - time.com/4555350/retirement-moves-couples-50s/

2 - tradingeconomics.com/united-states/personal-savings

3 - wallethub.com/edu/credit-card-debt-study/24400/

4 - billmoyers.com/2013/09/20/by-the-numbers-the-incredibly-shrinking-american-middle-class/

5 - tradingeconomics.com/united-states/inflation-cpi

6 - ycharts.com/indicators/personal_saving_rate