Want to Save More For Retirement? Get A Plan.

We all want to have enough money to enjoy our retirement, but the majority of Americans are falling short when it comes to achieving their goals, and they know it.

Newly-released data from the Indexed Annuity Leadership Council (IALC) 2017 survey of American adults finds most Americans are afraid that their money will run out before their life runs out (56%), but they are nearly as afraid of running out of money while they are still alive or that they won’t have the funds to enjoy their life and cover basic necessities. According to a 2016 survey, a close third financial fear is they may someday be unable to cover their health care expenses (19%). To compound matters, Americans aren’t taking the actions necessary to address these fears. Twenty percent of Americans have absolutely nothing saved for retirement, one quarter of Baby Boomers have less than $5,000 saved, and 1 out of 5 Americans do not know what they had saved for retirement. 1,2

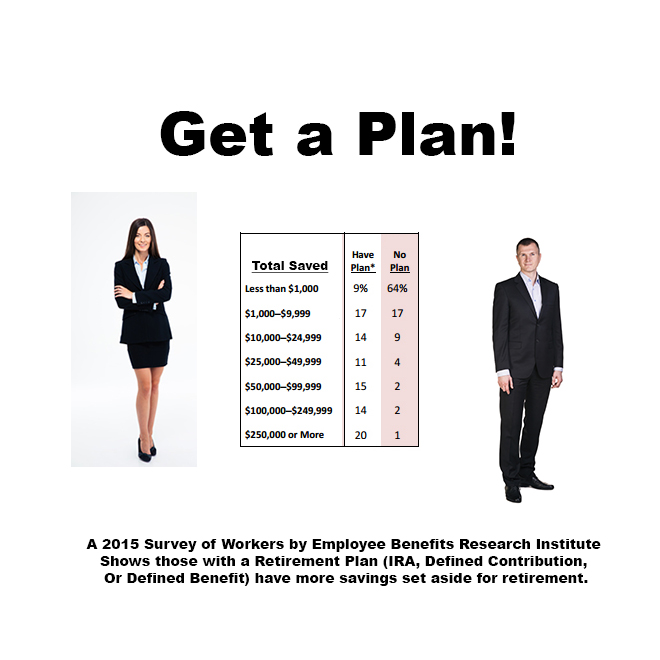

Often we will avoid the things we fear, and put off important decisions or actions as a result. Fear can be paralyzing, but retirement is on a timeline that will not wait. It is important to take action, but it is equally important to take the right action. The Employee Benefit Research Institute Retirement Confidence 2019 Survey shows a distinct difference between those who have enrolled in a defined benefit (DB), defined contribution (DC), or IRA retirement plan and those who have not. Those investing in a plan are much more likely to have substantial assets put aside for retirement compared to those who do not participate. 3,4

It looks bleak for those generations coming up after the Baby Boomers too. A "fear of financial planning" study March 26th through April 3, 2013 conducted by Nationwide Financial among 783 primarily Millenials and Gen Xers who currently have $100k or more in investable assets shows 83% of these investors fear there will be another financial crisis, and 72% fear their health care costs will be unmanageable. Additional top fears are that they may not be able to afford their children’s education, will never be able to retire, and will never pay off their mortgage. In 2019, the top fear among Americans was simply that they’ll run out of money before they die. 3,5

A great deal of fear comes with the unknown and perceived risks. Participating in a structured retirement plan may be a good first step.

Citations.

1 - https://fiainsights.org/2017-year-uncertainty/

2 - 2 -https://indexedannuitiesinsights.com/retirement-data/

3 - https://www.ebri.org/docs/default-source/rcs/2019-rcs/2019-rcs-short-report.pdf

4 - https://www.nationwide.com/nf-fear-of-financial-planning.jsp

5 - https://www.journalofaccountancy.com/news/2019/feb/top-retirement-fears-201920387.html